This Ain't a Scene, It's a CTC Arms Race

Politicians from both parties are saying they want to supercharge support for parents next year, but what's realistic?

Football is back, baby, and what’s better than a newsletter that combines football and babies? But you gotta eat your policy vegetables first. On tap:

The Main Event: How Big Can CTC Fans Dream?

Side Show: Deion Sanders and NIL for Babies

It’s Me, Hi: COMPACT, Family Studies, and more

Et Cetera

The Main Event

This year’s Presidential election, with its surprisingly heavy focus on matters of family and fertility, comes in advance of next year’s “tax armageddon.” The changes to the Child Tax Credit (CTC), along with other provisions, as a result of 2017’s Tax Cuts and Jobs Act are scheduled to expire if Congress fails to act.

Lawmakers want to avoid parents seeing the amount of their per-child tax relief fall by half, and to hear the rhetoric from both Presidential tickets, you might think we’re in for - in the words of AEI’s Kyle Pomerleau - a “CTC arms race.” But given that a trifecta in either party’s direction this November seems unlikely, it’s never too early to start game planning what an actual compromise might look like.

The Kamala Harris campaign has proposed resurrecting the Biden administration’s pandemic-era expansion of the CTC. That provided monthly checks to all parents with incomes under $400,000 (or $200,000 for single parents) worth the equivalent of $3,600 per child ages 0-5 and $3,000 for each child age 6-17. Harris also endorses increasing the amount of tax credit for the first year of a child’s life up to a total of $6,000. The Tax Foundation estimates this approach to CTC expansion would cost about $1.2 trillion over 10 years; controversially for many Republicans, this would include monthly checks going out to all parents, even those who are not working.

Former President Donald Trump championed his “historic” doubling of the CTC from $1,000 to $2,000 per child during his (first?) term in office. Of course, because this was part of a broader suite of tax reform proposals, including getting rid of dependent exemptions, it’s not strictly accurate to say parents saw their benefits double (and, as has been covered before, some working-class parents do not receive the full CTC amount because of the way the credit is structured.) Currently, the 2024 GOP platform sets a goal of “mak[ing] permanent the provisions of the Trump Tax Cuts and Jobs Act that…expanded the Child Tax Credit.”

His running mate, Ohio Sen. J.D. Vance, has been a prolific champion of the Child Tax Credit, telling CBS News he’d “love to see a child tax credit that's $5,000 per child…and I think you want it to apply to all American families.” While the Trump campaign told Semafor’s Joseph Zeballos-Roig they are “consider[ing] a significant expansion of the child tax credit,” $5,000 per kid would be pretty pricey. Plugging that value into the Committee for a Responsible Federal Budget’s “Build Your Own Child Tax Credit” estimator spits out a 10-year budget score of somewhere in the vicinity of $2.5 trillion.

Vance may have tossed out an aggressive number, but he is far from the only Republican in favor of expanding the CTC, which has traditionally received bipartisan backing. In his race against Sen. Bob Casey (D-Penn.), Republican Dave McCormick has proposed increasing the child tax credit to $4,200 for children under 5 and $3,000 from 6-17. And, of course, three-quarters of House Republicans voted for increasing the CTC’s ability to benefit lower-income families, among other provisions, earlier this year.

But in the event Republicans control at least one house of Congress next year, there will be a slew of tax priorities competing with the Child Tax Credit for space on the dance card. Convincing tax bill writers to allocate a couple trillion dollars to a part of the tax code some Republicans are already leery of would require some real political heavy lifting, to say nothing of boosting the credit for low-income households in the way Democrats would like to see.

So while tossing around lots of dollar signs might turn heads, in any scenario but a Democratic trifecta it strikes this observer as unlikely we’ll see something with as big a headline number as in the Biden-era CTC. A bare-minimum ask for pro-family advocates would be to account for the skyrocketing inflation families experienced in the pandemic’s aftermath, which ate away a chunk of the CTC in real terms.

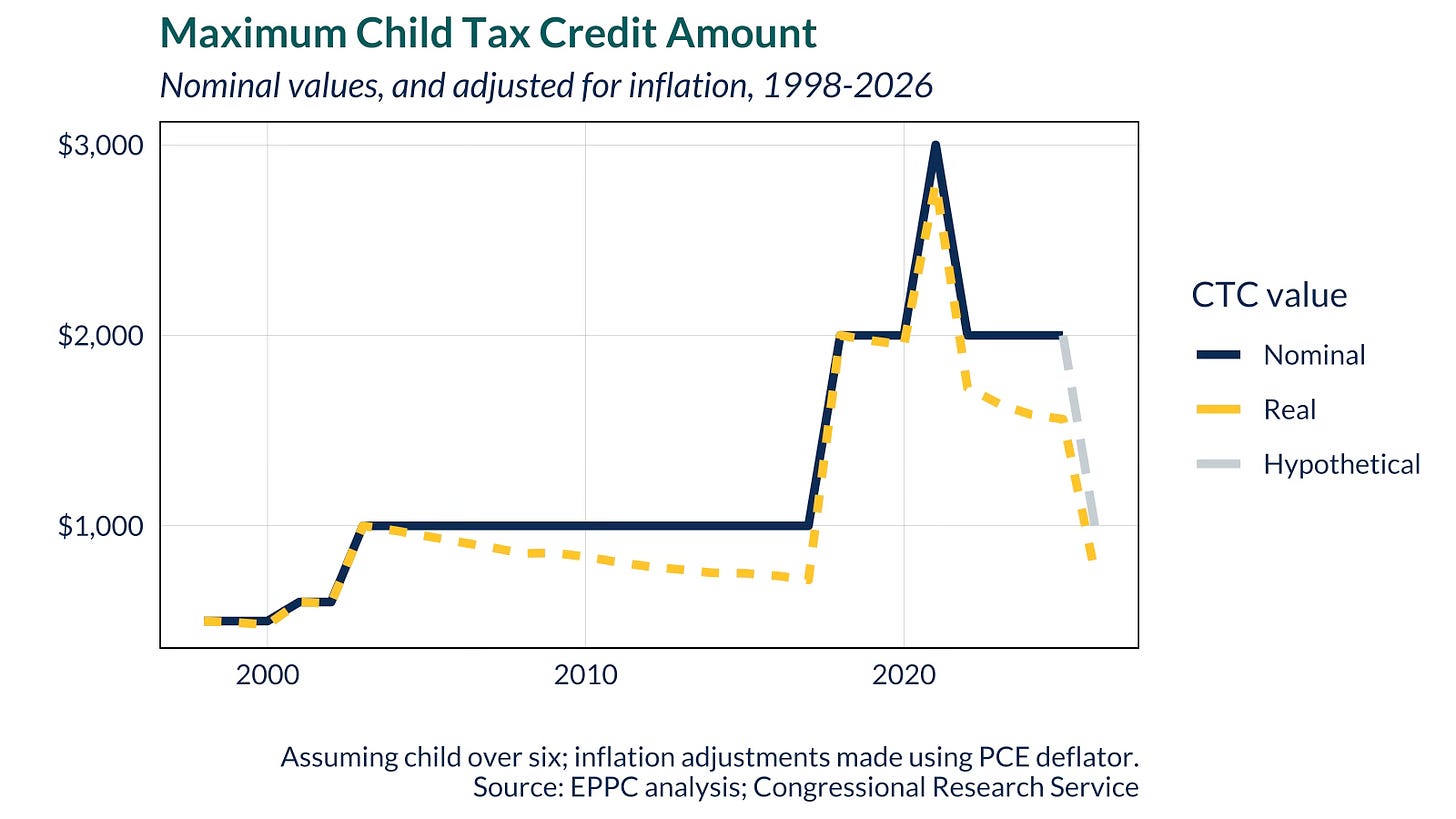

The yellow dashed line is what parents actually feel in their pockets, eroding over time as inflation eats away at the static nominal figure. That “hypothetical” grey line is what is in the statute, but almost certainly won’t come to pass assuming members of Congress want to keep their job. We clearly see how relying on Congress to prevent the real value of the CTC from eroding over time isn’t a stable source of financial security for parents. Not indexing the CTC for inflation, in the way that the standard brackets and exemptions are, costs families a decent chunk over time.

Adjusted for the cost of living, that $2,000 max credit in 2018 is worth around $1,580 today. Accounting for the cost of inflation since 2018 would look something like $2,500 today (rounding up), which feels like a solid starting point for any serious CTC negotiations.

Of course, I still favor proposals to rethink our entire system of child-related tax benefits, such as in the excellent Family Security Act 2.0 proposed by Senator Mitt Romney. No one knows how thin Congressional majorities may be next year, and where the political winds may be blowing. But in the likely landscape in which the CTC has to fight with other tax provisions to get across the finish line, a goal of bumping up the credit and indexing it to inflation may be realistic, and useful to many parents, even if it’s not quite the shock-and-awe result some might be hoping will come out of this month’s “arms race.”

Side Show

The current era of Name, Image, and Likeness (NIL) payments to college players, to say nothing of the incessant and increasingly nonsensical conference re-alignments, has led some observers to sour on college football (though, given the record ratings for Notre Dame’s win at Texas A&M last week, not everyone feels that way (Go Irish).) But one of the most polarizing coaches in the country, Colorado’s Deion Sanders, has used NIL in a surprisingly pro-child direction.

Sanders helped the 5430 Alliance, the NIL collective for the Colorado Buffaloes, to engage a local credit union to open up 529 savings plans for the eight children of players on the Buffs' football team, each with a starting amount of $2,121 dollars in it. In announcing the program, Coach Prime stressed the importance of engaged fatherhood:

“A child is not a mistake. A child is an opportunity to mature you, grow you, advance you and give you some skills. Y’all know how I am about fathering. I would not hire a coach unless he’s a great father. I don’t hire a coach that’s a deadbeat, I don’t hire a coach that’s not taking care of his responsibilities. I would never hire a man that he says he’s going to look after y’all but he won’t look after his. That don’t make sense to me.”

Sanders grew up with a single mother, and has spoken, half-jokingly (?), about how family structure shapes the mindset of the players he recruits (two-parent households reportedly produce the best quarterbacks, while defensive linemen raised by a single mom are more likely to play with abandon, “trying to rescue mama.”

It remains to be seen (to put it gently) whether Sanders’ unorthodox approach to recruiting and coaching will help bring Colorado back to football glory. But part of creating a more parent- and family-friendly society starts with both spreading the message that “a child is not a mistake,” as well as backing it up with actual resources and encouraging dads to do the right thing. Kudos to Coach Prime, and best of luck to the Colorado Kids.

It’s Me, Hi

My piece for COMPACT magazine on why Trump should drop his IVF proposal and focus on childbirth costs:

Coupling a “baby bonus” check with policies to cap or eliminate out-of-pocket spending at childbirth would help the Republican ticket deliver on their vision of a working-class, pro-parent party. And it could be done in a more fiscally sustainable way. Rather than proposing policy from a defensive crouch, Trump-Vance should offer confident, bold approaches to benefit all American families.

And my take on successful purple-red state governors for Family Studies, building off a recent newsletter piece:

What we see in the form of [Glenn] Youngkin, [Brian] Kemp, and [Bill] Lee is an emerging form of pro-family politics that can have success in purplish-red states. It seeks to meaningfully improve parents’ lives without breaking the bank and uses popular successes as ballast when defending socially conservative principles that poll less well. It may not be as popular online as more muscular forms of culture war pro-natalism. But if it appeals to voters in Virginia, Tennessee, and Georgia, it may be worth a try elsewhere as well.

In the aftermath of Trump’s comments on abortion and IVF last week, The Guardian excerpted last week’s Family Matters…Kate Scanlon of Our Sunday Visitor and Brigham Tomco of Deseret News also included my comments in their coverage…Kimberley Heatherington quotes me and others on the upcoming CTC debate for OSV News…Tim Chapman of Advancing American Freedom cited our recent EPPC report in his memo regarding the upcoming Florida amendment…Alice Miranda Ollstein and Meridith McGraw quoted me and other pro-lifers in response to Trump's abortion missteps for Politico

Et Cetera

Events: New Census Data on American Families’ Economic Well-Being, feat. Kevin Corinth, Vanessa Brown Calder, Bradley Hardy, Michael Strain, and Scott Winship (AEI, Sept. 10)

Articles: Trump Contorts Himself on Abortion in Search of Political Gain (Jonathan Swan and Maggie Haberman, New York Times)…Conservatives deride Trump’s IVF plan as worse than Obamacare contraceptive mandate (Gabrielle Etzel, Washington Examiner)…'Women Are Not Stupid': Democrats Scoff At Trump's Pledge To Cover IVF Costs (Igor Bobic, Huffington Post)…A Newborn Tax Credit Could Be Worthwhile, With Sound Administration (Margot Crandall-Hollick, Tax Policy Center)…How America’s Baby Bust Became an Election Issue (Liz Essley Whyte, Wall Street Journal)…Trump claims boosting tariffs will pay for child care but doesn’t explain how (Tami Luhby, CNN)…Rep. Rosa DeLauro says Dems must own CTC expansion (Laura Weiss, Punchbowl News)

Takes: Will the Care Agenda Make It This Time? (David Dayen, The American Prospect)…Trump’s IVF Plan Is a Mistake (Vanessa Brown Calder, Cato at Liberty)…Triumphalism After Dobbs Was a Mistake (Marvin Olasky, Christianity Today)…About Those “Childless Cat Ladies” (George Hawley, City Journal)…Donald Trump’s IVF plan doesn’t go far enough (Miriam Cates, UnHerd)…Pro-Life Realism Post-Dobbs (Michael Brendan Dougherty, National Review)…Mandating Insurance Coverage For IVF Will Not Boost Fertility (Lyman Stone, Family Studies)

Roundup: New York: Some Democrats worry abortion amendment could be in trouble…Kansas: Gov. Laura Kelly vetos bill that would have required dads pay child support during pregnancy…Gov. Kelly also signed a bill reducing property and income taxes, increasing the standard deduction, and increasing the state's Child and Dependent Care Tax Credit…Indiana: Martin University, a predominantly black university in Indianapolis is opening a free half-day preschool program to better support its students…West Virginia: Gov. Jim Justice calls lawmakers for special session on income tax cut and Child and Dependent Care Tax Credit…Nebraska: Voters will be asked about a pro-choice, pro-life and paid leave amendment on the ballot this fall.

How we doin’? Send me a postcard, drop me a line, and then sign up for more content and analysis from EPPC scholars.

It's hard to know what the Vance proposal costs because we don't know how much is refundable.

The two big issues on the CTC are always the same:

1) How refundable will it be.

2) Will it have any kind of income phase out.

The "ideal" Democratic CTC is probably something like what Tim Waltz did in MN. Fully refundable and income phased out starting at $35,000 a household! You're basically talking about a cash welfare program for ghetto baby mamas at that point.

The GOP benefits tend to be less refundable and universal. Vance says he doesn't want an income fade out. In an idea world the GOP would probably make it scale with income and target the middle to UMC married households (GOP voters).

Here is my own take on what should pass:

Harris CTC = $160B

Payroll Taxes = $1,500B

Refund employee FICA for two kid households and employee + employer (15.3%) for 3+ kid households.

Median Family of Four $107,000 = ~$8,000 FICA Employer, $16,000 total

Median of five would get $9,000+ (Harris) and $16,000 (GOP) for $25,000 total. Now that's a CTC!

In 2022, 40% households with children.

14,444 One Child (43%,17%) - $255B

12,472 Two Children (37%,15%) - $220B * 50% = $110B

7,008 Three Children (20%,8%) - $125B * 100% + $125B

$110B + $125B + $5B (remove Harris income cap) = $240B

$160B + $240B = $400B

Pay for with:

SS taxes over 400k (Dem proposal)

Full Repeal SALT (GOP, but could be DEM)

Full Repeal Mortage Interest (GOP, but could be DEM)

$400k SS = $110B

SALT = $210B

MORTGAGE INTEREST = $80B

Total = $400B

Revenue = $400B

Cost = $400B