In Our Child Care Policy Era

Republicans are getting closer to ideas that could meaningfully improve federal child care approaches

Baseball is back, baby. If it’s Friday, it’s Family Matters:

The Main Event: Republicans are forging new ground on federal child care policy

The Pro-Natalist New Yorker: Dozens of us, dozens

It’s Me, Hi: Fairer Disputations, NOTUS

Parting Shots

The Main Event

If I had to extremely overgeneralize, I might characterize the history of Republican attitudes towards child care as following into three broad buckets:

The Schlafly Era (1970-80s): President Richard Nixon vetos a national child care bill, heavily influenced by top advisor Pat Buchanan; Anti-ERA efforts are successfully premised on protecting homemakers.

The Dole Era (1990s-2000s): Welfare reform makes safety-net benefits contingent on work, driven by concern about rising single parenthood. Child care block grant viewed as bargain with liberals who would prefer to protect direct cash assistance (AFDC).

The (Ivanka) Trump Era (2010s-??): Child care seen as business and labor force issue, morphs from welfare policy to gender policy, essential to closing gender wage gaps and increasing female labor force participation. “Lean In” feminism gets its White House Summit.

What stage are we in now? A combination of all three.

I have written numerous times about how only pushing to expand public subsidies for child care is a blinkered vision of what “pro-family policy” should look like. The approach progressives favor, which was typified in Build Back Better, focuses on raising wages for child care workers and encouraging continuous quality improvements for facilities (while also sucking the most profitable kids up into universal pre-kindergarten). They’d then subsidize parents to the relatively arbitrary tune of capping expenses at seven percent of household income to account for the increased costs. This is (a) extremely expensive, (b) distorts the market, and (c) doesn’t do anything for the 45 percent of kids age 5 of under whose parents do not participate in at least one weekly child care arrangement (table A-1).

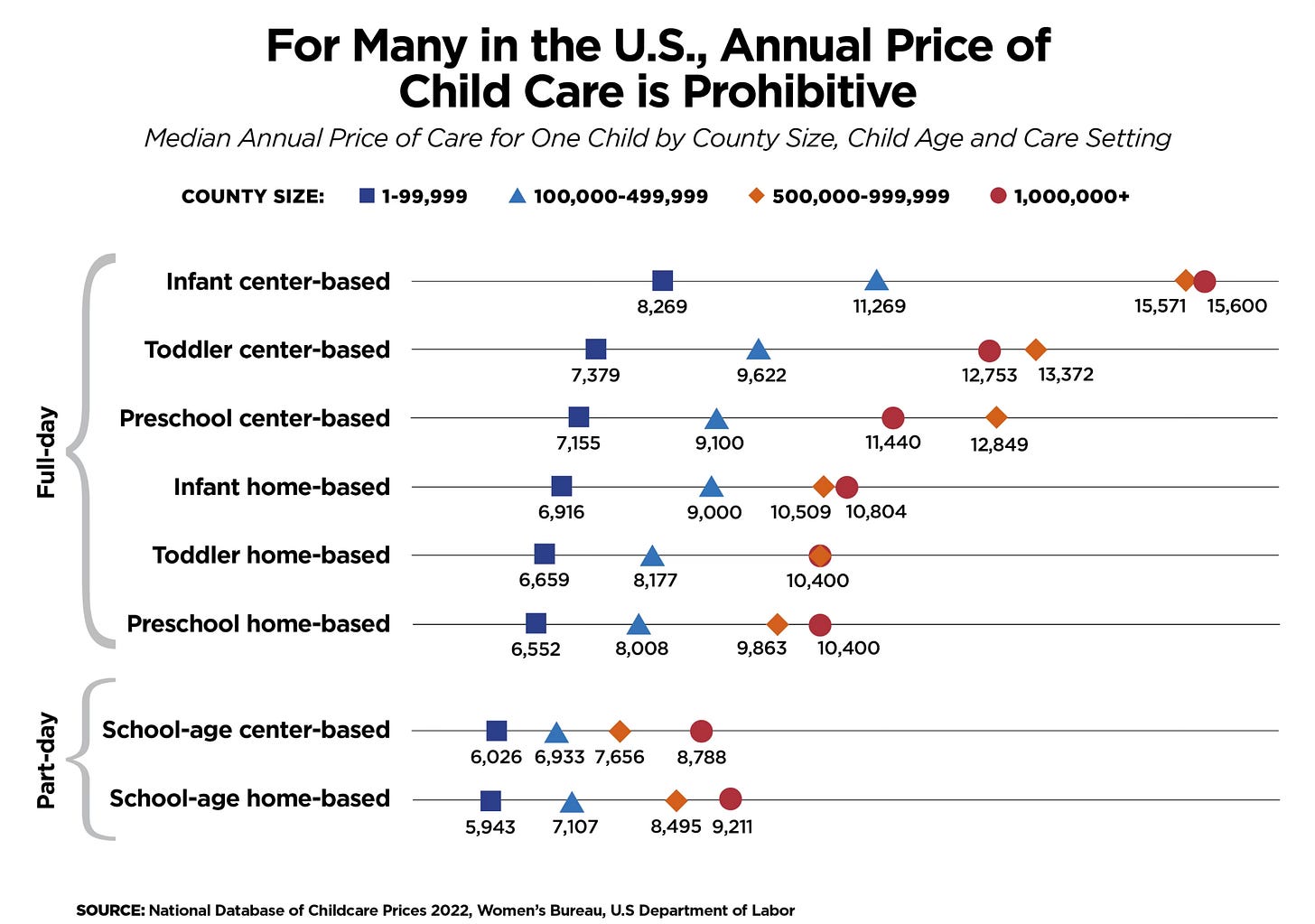

But Republicans — to their credit — recognize that child care costs are a huge burden on families that pay them, and that the party needs a better answer on questions of child care than the perspective offered by Idaho Rep. Charlie Shepherd in 2021: “(Any) bill that makes it easier or more convenient for mothers to come out of the home and let others raise their child, I don’t think that’s a good direction for us to be going.”1 For an infant in a big metro area, the median annual cost of care is about $15,600. For a toddler in a full-day preschool in a rural county, you're looking at closer to $6,660. That’s a big strain on many parents, from the 53 percent of college-educated who rely on a child care center, to the 70 percent of single parents who work full-time and rely on some form of external child care arrangement.

Family Matters has previously mentioned the Child Care Availability and Affordability Act, introduced by Sen. Katie Britt (R-Alabama) and Sen. Tim Kaine (D-Virginia), along with some bipartisan House co-sponsors. It straddles the Dole and Ivanka Trump approaches to child care policy, recognizing that the current Child and Dependent Care Tax Credit (CDCTC) is heavily distributionally skewed to upper earners because it is not refundable. It would fix that by increasing the refundability for lower earners (so low-income families would get a check back from the IRS for the difference between their available CDCTC and their federal taxes owed.)

The CDCTC is not my favorite piece of tax code kludgeocracy (all else equal, I’d prefer to just fold it into a young child supplement to the Child Tax Credit, which benefits all parents equally.) Florida State’s Luke Rodgers found that it’s as much a subsidy to providers as to parents, since the majority of the credit’s value gets passed through in the form of higher prices. But as far as it goes, it’s fairly inoffensive — all you need to claim the CDCTC is to be able to list the provider’s tax ID number or Social Security number, allowing for a fairly pluralistic approach to child care (especially compared to universalist schemes.) Building off the current CDCTC would an easy rhetorical win — and may even have the added bonus of being politically doable even with a narrow GOP majority.

The way to improve the Kaine-Britt bill would not to be further mess with the refundability structure, which accurately recognizes the weakness of a tax credit aimed at working families that presumes they have enough tax liability to wipe out (three-quarters of the total value of the CDCTC, per IRS data, goes to families making over $100,000 annually.) The bigger flaw is how eligibility for the credit is structured. Currently, all parents in a household must either be working, looking for work, or in school to claim the CDCTC — so families with a stay-at-home parent cannot deduct expenses to cover a babysitter during PTA meetings or offer a relative a little something to thank them for watching the other kids during an unexpected visit to the pediatrician.

The sponsors of the Child Care Availability and Affordability Act should allow all families, regardless of their work-life structure, to deduct babysitting, nannying, and child care expenses without both parents having to meet the work or training activity test. It’s a modest tweak that wouldn’t cost much money, and would broaden the ability of the CDCTC to support families from all walks of life.

Then there is the Respect Parents’ Childcare Choices Act, recently introduced by both Sen. Jim Banks (R-Indiana) and Rep. Riley Moore (R-W.V.) It would tackle the big legacy of Dole Era child care policy, the Child and Dependent Care Block Grant (CCDBG). For the purposes of this newsletter, I will abbreviate and say the CCDBG, done right, can be a useful method of giving low-income parents vouchers to take to the care provider of their choice, which in many states includes the options of grandparents and relatives (there is accreted red tape at the state level that enterprising reformers should dedicate themselves to clearing out.) The RPCC Act would supercharge some of what already exists, including the most controversial aspect of their plan — allowing parents with a stay-at-home parent to use a child care voucher to, essentially, “pay” the at-home parent for care provided.

They’re trying to tap into the Schlafly Era impulse to critique the non-egalitarianism mentioned above, but it makes less sense for a safety-net program aimed at low-income parents.2 80 percent of recipients are single parents — as mentioned, the logic of welfare reform compels work as a condition for assistance, and the CCDBG makes work possible for those households. The level of CCDBG funding is traditionally well below what it would take to ensure all eligible parents receive a child care certificate (in most states, it’s essentially a voucher); fewer than one in seven children who are eligible for CCDBG funds get the assistance.

Even with the bill’s increase in funding, it would broaden eligibility such that middle-income married couples with a stay-at-home parent may end up receiving public dollars designated to help low-income parents afford child care before the intended recipients saw their number called — if it ever was. Smudging the edges of what the CCDBG is for by allowing parents that get vouchers to, essentially, top up what they already get from the Child Tax Credit is a form of double-dipping for those lucky enough to get past the waiting list. (Schlafly herself endorsed a proto-Child Tax Credit that was essentially universal in scope, vastly preferring them to child care credits — the lessons and spirit of the Dole Era means that such a proposal would be dead letter today.)

CCDBG is a good program that could be made better with some of the impulses on display from Banks and Moore. Celebrating a diversity of care approaches and cutting red tape on providers is the right impulse — but it doesn’t need to stretch as, essentially, using public funds to pay parents for providing “child care.” They’re living family life, not providing a market service.

In 1984, Ronald Reagan told Americans that under Democratic rule, families had seen “the golden promise of the American dream disappearing behind storm clouds of economic misery. Liberals urged huge government subsidies paying parents for expenses they used to handle themselves, but big government becoming big brother pushing parents aside, interfering with one parental responsiblity after another is no solution.” Four decades later, conservatives are coming to the table with their own subsidies, and some laudable energy. But they shouldn’t dismiss the rhetorical strains hat Reagan was tapping into. If we’re going to provide subsidies parenthood — which we should — we should aim for as egalitarian a policy as possible. We should give parents power to choose their child care options on as level a playing field as we can muster, rather than giving some families windfalls and leaving similarly-situated families out of luck, or reimbursing babysitting expenses for dual-income families but not for their single-income peers.

The good news is that Republicans are interested in developing a new era of child care politics. Modestly tweaking the proposals currently on the table could make that possibility a reality.

Eustace Goes Pro-Natalist

“The Natal Conference” is currently taking place in Austin, and while I have some friends who will be speaking I have some...not friends on the agenda as well. One problem for the natalism movement is that it is too often associated with Silicon Valley types seeking to re-engineer human reproduction rather than support it, or Very Online types only interested in certain dimensions relating to population dynamics (I trust you know what I mean.)

Which makes the most recent cover of the New Yorker an interesting example of what a pro-family agenda should prioritize. I don’t have any data to suggest that the unaccommodating infrastructure dampens birth rates, but it certainly gives parents more headaches. As the artist who drew the illustration quipped, “My baby daughter is growing much faster than my stroller-lifting muscles.” Including parents (and the disabled, and the elderly) in how we build and maintain our cities is part of a pro-family agenda. I don’t know whether the artist was inspired by a viral tweet from Nicole Ruiz that captures some of this spirit:

“Respectfully, what am I supposed to do when the literal only path for me to get me + an infant/toddler from below ground on the subway to above ground is an elevator that a crazy person is clearly posted up in and not leaving?”

But it’s not just cities! More states should pass the bill signed into law in 2022 in Rhode Island, which requires that retailers offer stroller-friendly parking.

It would be fun to see conversation spark around the personal (no Good Samaritans on that cover!) and systemic burdens that make modern life too hard on new parents. Could the left and right join forces on an infrastructure agenda that makes life easier for parents? Maybe, maybe not. But attempting to do so feels more useful than the anonymous internet trolls ranting about our precious bodily fluids.

It’s Me, Hi

In my debut piece as a featured author for

, I explored some dynamics around the “vibe shift,” the post-woke moment, and whether Joe Roganism is likely to lead to a revivification of American marriage:“The audience for Barstool-type content, far from being recruited into an anti-feminist revolution, are easy marks for various social opiates. Joe Rogan and his imitators aren’t looking to repeal the Nineteenth Amendment. They don’t encourage men to sacrifice for anything beyond themselves. They just want men to be free to indulge their short-term impulses, whether through the dopamine hit of smartphone-fueled sports betting, the rush of an endless scroll of naked women, or the high of newly legalized marijuana.” (Fairer Disputations)

Emily Kennard interviewed me, Sen. Josh Hawley, and Rep. Blake Moore around some of the conversations, or lack thereof, around supporting families and responding to the challenge of low birth rates taking place on Capitol Hill. (NOTUS)

“We’re still trying to get people in Congress to take this as seriously as the problem demands.”

Claire Cain Miller links to a recent EPPC/IFS survey on family policy perspectives in her piece noting that Republican voters have become more open to forms of proactive family policy. (New York Times)

Parting Shots

Rachael Wolfe explores declining marriages rates through the lens of women who have largely given up on what men are bringing to the table: “If I need companionship, I volunteer at the dog shelter.” (Wall Street Journal)

Anna Louie Sussman is writing an in-depth series exploring embryo research and the scientific and moral limits around it (New York Times)

A new report by the Niskanen Center’s Josh McCabe and Leah Sargeant lays out prudent steps towards disentangling family adjustments from credits for low-wage workers, and cleaning up both the EITC and the CTC

As part of his efforts to “Make America Healthy Again,” HHS Secretary Robert F. Kennedy, Jr., has announced plans to eliminate about one-quarter of the agency's workforce, including 19% of the workforce of the Food and Drug Administration and 18% of the Centers for Disease Control (Wall Street Journal)

This is an absolutely gutting and empathetic essay on the holes in America's social fabric left behind by our opioid crisis by Amber Lapp (Commonplace)

Ashley Losoya offers a compelling case for why House leadership should get over their opposition to the push from members to allow proxy voting by new parents (Deseret News)

In Michigan, senate Democrats are proposing a state tax credit that piggybacks off the EITC (good intention, questionable execution), an expansion of the Rx Kids program that gives parents in Flint up-front cash payments during pregnancy and childbirth (great idea), and removing red tape for child care providers while expanding their state's unique Tri-Share program (intriguing and worthwhile experimentation)

In New York, Republicans in the state senate have proposed a $1,000 refundable tax credit for all parents of newborns and a first-time homebuyer tax credit as part of their “affordability agenda”

A new law in Colorado will require child care providers to provide prices up front for families, and require that application or wait list fees be refunded if a child is not accepted after six months. Targeted efforts to make an often-opaque market more user-friendly.

Mississippi has passed a law providing parental leave to state employees who welcome a child…and the Iowa state house approved providing paid leave to state workers.

In South Dakota, Gov. Larry Rhoden vetoed a bill to make child care workers categorically eligible for child care subsidies, on the grounds that one category of workers shouldn't be subsidized at the expense of others.

He Jiankui, who was imprisoned and sanctioned for running gene editing experiments on embryos, is seeking a comeback with the view that “Ethics is holding back scientific innovation and progress.” (Wall Street Journal)

“Because people currently do not perceive the level of social support and trust to which they are biologically adapted, they seek alternatives. One coping strategy may involve transferring genetically based prosocial attitudes, such as the tendency to engage in parental behavior, to dogs.” Eötvös Loránd University’s Eniko Kubinyi

My EPPC colleague knocked it out of the park at her testimony before the House Subcommittee on Commerce on Big Tech and age verification, among other topics. Read more here:

Comments and criticism both welcome, albeit not quite equally; send me a postcard, drop me a line, and then sign up for more content and analysis from EPPC scholars.

Devoted Family Matters readers will recall another recent Idaho cameo, in which the state was preparing to eliminate virtually all state regulations of child care and pre-empting any local regulations as well. Per , the state legislature amended the bill after it passed both chambers, essentially replacing the elimination of regulation with a modest loosening of child-to-staff ratios:

The bill’s fact sheet also touts an ability to protect religious providers, which is mostly superfluous thanks to far-sighted lawmakers who codified strong religious freedom protections in the CCDBG authorizing legislation.