I Believe the Children Are Our Future

A menu of options for next year's Child Tax Credit showdown

Two-and-a-half weeks remain until Election Day, and here’s a pro-tip: if you want to avoid the onslaught of campaign season advertisement, have your only source of media consumption be artisanally-crafted newsletters on pro-family policy. Welcome to Family Matters. On tap:

The Main Event: New Memo Gives Congress Options on the CTC

Sneak Peak: Why marriage promotion isn’t a GOTV strategy

Pro-Natal Jam of the Week: Charli XCX’s “I think about it all the time”

It’s Me, Hi: Politico, PolicySphere, and more

Et Cetera

The Main Event

Everything in Washington, D.C., is governed by 10-year budget windows. And in an effort to cram as many tax changes as they could into 2017’s Tax Cuts and Jobs Act (TCJA), lawmakers sought to conceal the long-run impact of their expansion of the Child Tax Credit and other individual-side tax provisions. Instead of making the changes permanent, they sunsetted them (on paper) in 2025. Which means that if Congress does not act, the value of the Child Tax Credit will fall from its current level of $2,000 per child to its pre-TCJA value of $1,000 per child.

This would be an effective tax hike on millions of parents, and politicians tend to avoid pulling that kind of stunt if they can help it. Both sides of the race for the White House have mentioned the CTC: The Trump campaign agenda pledges to make the TCJA provisions (doubling the standard deduction and CTC) permanent, while the Harris campaign seeks to restore the pandemic-era expansion of the CTC.

How, then, should Congress proceed? In a new memo, released by myself, scholars at the Niskanen Center, and other leading social conservatives, we offer policymakers some options for how to go about improving the Child Tax Credit in next year’s tax negotiations.

In brief, our memo calls for:

Increasing the top-line value of the Child Tax Credit to at least $3,000

Improving the Child Tax Credit’s ability to deliver for working-class households

Reducing marriage penalties by eliminating Head of Household filing status

Curbing improper payments by expanding Social Security Number requirements

Providing immediate economic support to parents at the time of childbirth

If you’re a staffer on Capitol Hill, I’d be more than happy to walk through the implications of these approaches to tax policy. Hit me up. If you’re not a staffer on Capitol Hill, I’m still happy to walk through it, but my sense is that you’re not interested enough to read through a whole newsletter that tried to get you interested in tax policy. But you can still hit me up.

Special thanks to Josh McCabe, Leah Sargeant, David Jimenez, Ramesh Ponnuru, Brad Wilcox, Patrick Purtill, Jon Schweppe, Kristan Hawkins, Mark Rodgers, Duncan Baird, Ivana Greco, and others whose support will be kept in camera until the time is right.

Sneak Peak

I believe the children are our future, and also that good journalism, in order to have a future, must have a paywall. So I appreciate that the good folks COMPACT magazine have to make ends meet. But I’ve also been met with some skepticism about the Twitter-length form of my argument that boosting marriage will not solve the GOP’s problems, so let me condense the argument into as brief space as possible.

Essentially — Married women are more likely to vote for the Republicans than single women, but a naive comparison of those two groups ignores that marriage is not randomly assigned, especially as the average age of marriage continues to creep upwards and overall rates fall. Your average married woman is older, white, and more economically comfortable than your average single woman - getting the latter married doesn’t change those demographic facts.

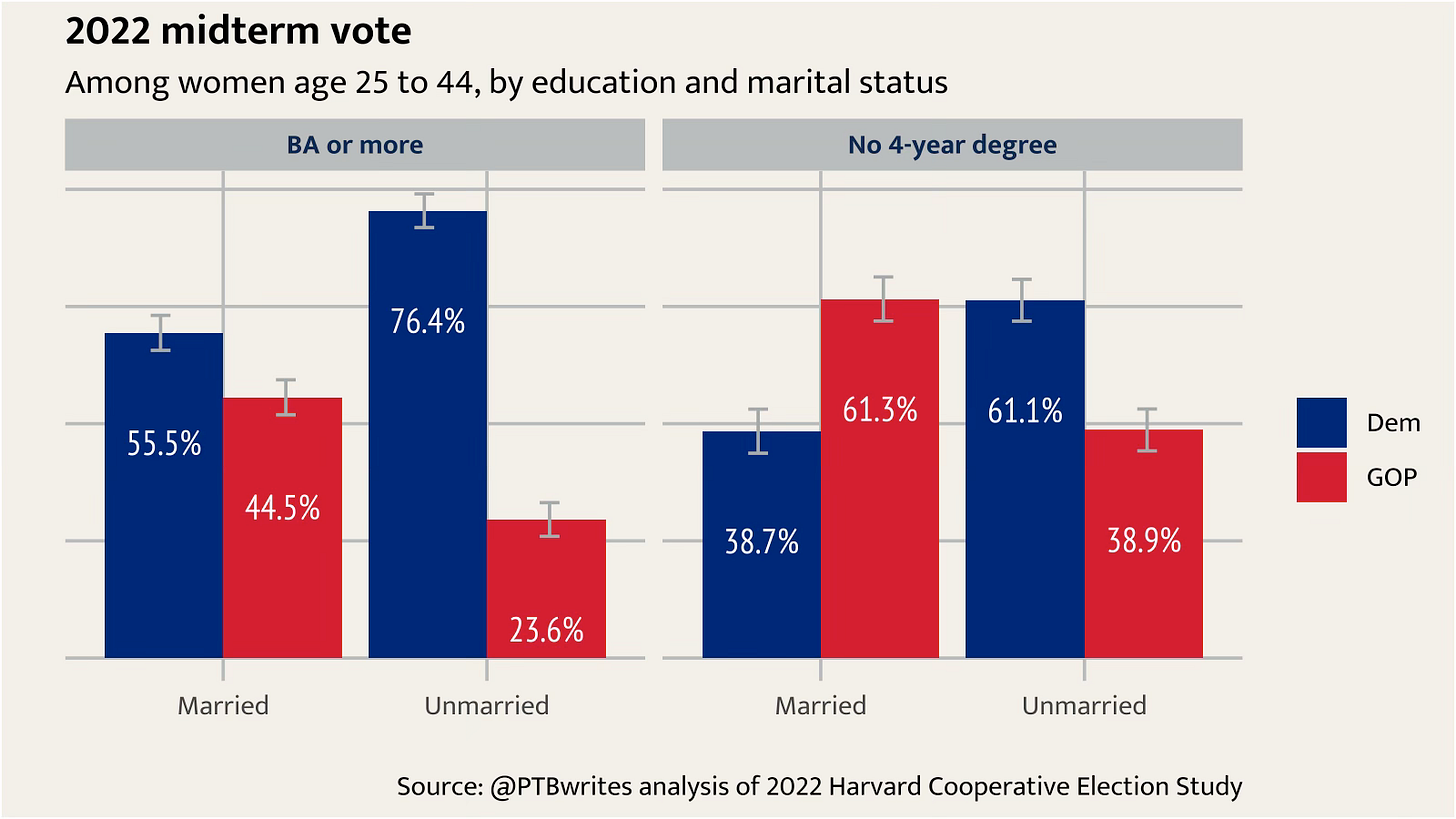

We can see this clearly in focusing on women in their childbearing years (under 45) and breaking it out by college attainment:

Unmarried women without a college degree do skew towards the GOP. But they are increasingly a minority as college education becomes more common and marriage rates fall for working-class Americans. Meanwhile, married women today are more likely to have a BA, and while they are more likely to vote for the GOP than their single peers, they still favor the Democrats by a 55-45 split. So just assigning single women a reliable romantic partner will not be enough to make inroads among college-educated women who are turned off the GOP’s positions on other policy matters.

Pro-Natal Jam of the Week

I’m clearly not brat, nor ever will be, but

highlighted a song by Brat Summer queen Charli XCX that is perhaps the most explicit endorsement of pro-natalism put to popular song in…years?And they're exactly the same, but they're different now

And I'm so scared I'm missin' out on something

So, we had a conversation on the way home

Should I stop my birth control?

'Cause my career feels so small in the existential scheme of it

It’s Me, Hi

Dan McClaughlin of National Review responds to my Dispatch piece on Sen. JD Vance’s abortion answer in the VP debate: “If you want to make the case for life, make the case for life.”

Pascal Emmanuel-Gobry of PolicySphere responds to my Compact piece on marriage, single women, and the GOP.

Politico Pro (paywalled) covers our CTC letter to the Hill:

The overall goal of the memo, according to its signers, is to prod Republicans to consider the needs of parents first and foremost during next year’s debate, even as the exploding federal debt might cause fiscal constraints for any final tax deal.

“With all of the campaign promises being thrown around, the GOP can’t afford to forget about delivering for families especially with the theoretical expiration of the $2,000-per-child CTC,” said Patrick T. Brown of the Ethics and Public Policy Center.

For The Dispatch, I suggest social policy outcomes to watch for if either Presidential ticket wins as part of the election symposium:

[A] second Trump administration would also exert an almost-irresistible force that would continue the GOP’s shift away from prioritizing fiscal sanity and the cause of protecting unborn life, even as it forestalls the possibility of worse outcomes under a potential President Harris.

And for Newsweek, I toss out my Presidential prediction as part of their 2024 election roundtable:

The air is slowly leaking out of the "Politics of Joy" balloon. Unless she's able to change the dynamics of the race, the downside risk is now firmly on VP Harris' side of the ledger. Barring a major surprise, Trump will just barely grind out a win in Michigan and Pennsylvania, and thus win back the White House.

Et Cetera

Reports

Invisible Labor, Visible Needs: Making Family Policy Work for Stay-At-Home (And All) Parents (Ivana Greco and Elliot Haspel, Capita)

Articles

Italy criminalizes surrogacy sought by Italian citizens abroad (Hannah Brockhaus, Catholic News Agency)…Trump pledges to ‘readjust things’ when pressed on child tax credit policy (Emily Hallas, Washington Examiner)...In a Bid to Feed More Families, WIC Diversifies Its Menu (Emily Schmall, New York Times)…How the U.S. economy became so hostile to parents (Venessa Wong, Marketwatch)…Worldwide Efforts to Reverse the Baby Shortage Are Falling Flat (Chelsey Dulaney, Wall Street Journal)…Can the Government Get People to Have More Babies? (Motoko Rich, New York Times)…Teen Online Curbs Give Family Values Groups Some Unlikely Wins (Brenna Goth, Bloomberg)…Congress Eyes Tax Code for Workplace Family-Friendly Benefits (Diego Areas Munhoz, Bloomberg)

Takes

Republicans’ Recurring Family Policy Fight (Sam Silvestro, American Compass)…Both Parties Are Getting Men Wrong (, Politico)…Republicans Should Think Twice About Funding IVF (Natalie Dodson, First Things)…Harris’s home health-care plan is no easy fix (, Washington Post)…Joint Review: Family Unfriendly by Tim Carney (The Psmiths,

)…Women’s labor force participation by age (The FRED Blog, St. Louis Fed)…The 2024 Campaign Brings Dueling Idiocies on IVF (Ramesh Ponnuru, National Review)Roundup

Michigan: "Momnibus" maternal health care package passes State Senate...and stakeholders are proposing child care-friendly zoning ordinances and reducing the fees associated with starting a child care business in the Grand Rapids area…Missouri: Gov. Parson says legislature needs to do a "better job" addressing issues like child care…Washington: Voters will decide whether or not to approve a capital gains tax, which would have its revenue devoted to K-12, higher ed, and child care programs…Minnesota: St. Paul voters will decide whether to raise property taxes to pay for child care subsidies…Colorado: State may disallow religious child care providers giving preference to congregation members

Send me a postcard, drop me a line, and then sign up for more content and analysis from EPPC scholars.

$3,000, pathetic!! You ought to be shooting for at least 3x that.

The problem is refundability. You're wasting dollars on poor people. And you're not targeting larger families specifically.

In addition to your $3,000 you should refund the employee part of FICA for families with two kids (7.65%) and all of FICA for families with 3+ kids (15.3%).

For a median family this would mean another $8k for the second and another $8k for the third.

This gets around the refundability issue because FICA is flat tax from first dollar. It scales with income (good) and rewards marriage (if you married both get the tax break). If gives zero to some single mom that isn't working (good). And it doesn't waste money on households with just one kid (they can manage on their own).

It's also justifiable in that future FICA taxes are paid for by current children. Those with large families are already contributing their fair share to FICA through the expenses of raising children. They should not be double taxed.

Permanently eliminating the SALT deduction would fund 90% of the benefit.

Functionally, you would keep collecting FICA taxes and putting them the "trust fund", but you would then issue people a refund from the general fund when they filed their taxes.