If you’re not picking Coach Staley and the Gamecocks to go all the way, you’re doing it wrong. Happy March Madness! If it’s Friday, it’s Family Matters:

The Main Event: Are Hungary’s Family Policies Working?

Back in the U.S.A.: A look back at 2023 birth data

It’s Me, Hi: Our Sunday Visitor, Americans United for Life

Parting Shots

The Main Event

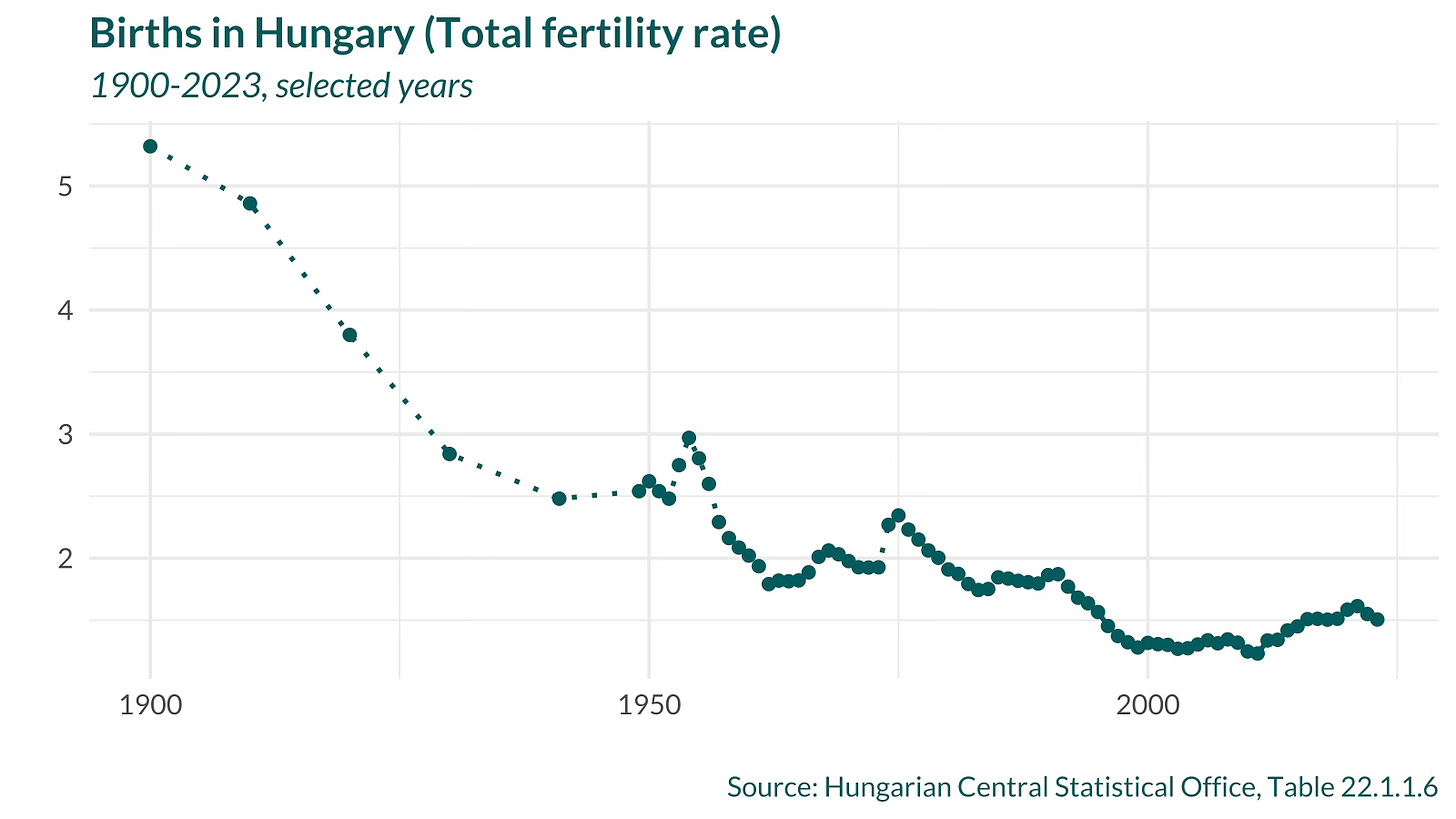

The nation of Hungary has won the heart of many self-described post-liberals for its muscular approach to pro-natalist policy. Even those who aren’t sold on all (or many) facets of Orbanism can appreciate the vigor with which it has thrown itself into offering a different path forward than meekly accepting its demographic fate. The land-locked nation with a population about the size of New Jersey, has persisted despite a centuries-long history of invasion and occupation is proud of its unique language, heritage, and place as the spot where Western and Eastern Europe meet; and the long-term trajectory is sufficiently dire to merit throwing everything at the wall to see what sticks.

Just this past month, Hungary once again got plaudits from Elon Musk, The Daily Signal, Lila Rose, and other conservative voices for its latest attempt to juice birth rates: eliminating income tax on women who children until they turn age 30, and removing it altogether for women who have two or more children. Orbán’s government also announced it would be capping rates on home loans, and instituting price controls on 30 major food items as it struggles to deal with the highest inflation rate (5.7%) in the EU ahead of next year’s election.

We’ll get to the wisdom of the latest tax cut down below. But first, let’s do a quick recap of how Hungary’s pro-natalism is bearing fruit so far. No one can accuse Fidesz of not bringing fiscal firepower to bear in a way that populist right parties in the U.S. could only dream of (though France still has some lessons for us all). As the Manhattan Institute’s summarized in 2022 for Law & Liberty, the country has been often cited as an example that pro-natalist policies can work — albeit at a high cost:

Pronatal policy works, but you have to go big…Its more recent efforts include loans of up to $33,000 to married couples that are partly forgiven if they have two kids and fully forgiven if they have three, subsidized fertility treatments, and total exemption from income taxes for women with four kids. Hungary is strongly advancing the message that fertility is a good thing and spending lots of money to encourage it, to an extent that would probably be hard to match in the U.S.

Is the proof in the pudding? Well, sort of. Thanks to the Hungarian government’s excellent statistics office (seriously, DOGE, stop cutting the bureaucrats who help run statistical agencies, it won’t be worth it in the end!), we can see what kind of impact Hungary’s bazooka of pro-natalist spending has had:

2019 is when Fidesz rolled out its expanded supports for families, including a child allowance, subsidized loans, mortgage deductions, car purchase grants, child care, etc. And overall, the results speak for themselves — Hungary has managed to stem their country’s demographic free-fall, though the optimism with which some pointed to 2019—2022 as proof of concept may be showing some signs of reversion to the mean. It’s possible the rollout of new benefits helped accelerate already-planned births rather than necessarily inducing additional births; which is nice, demographically, but not a slam-dunk win.

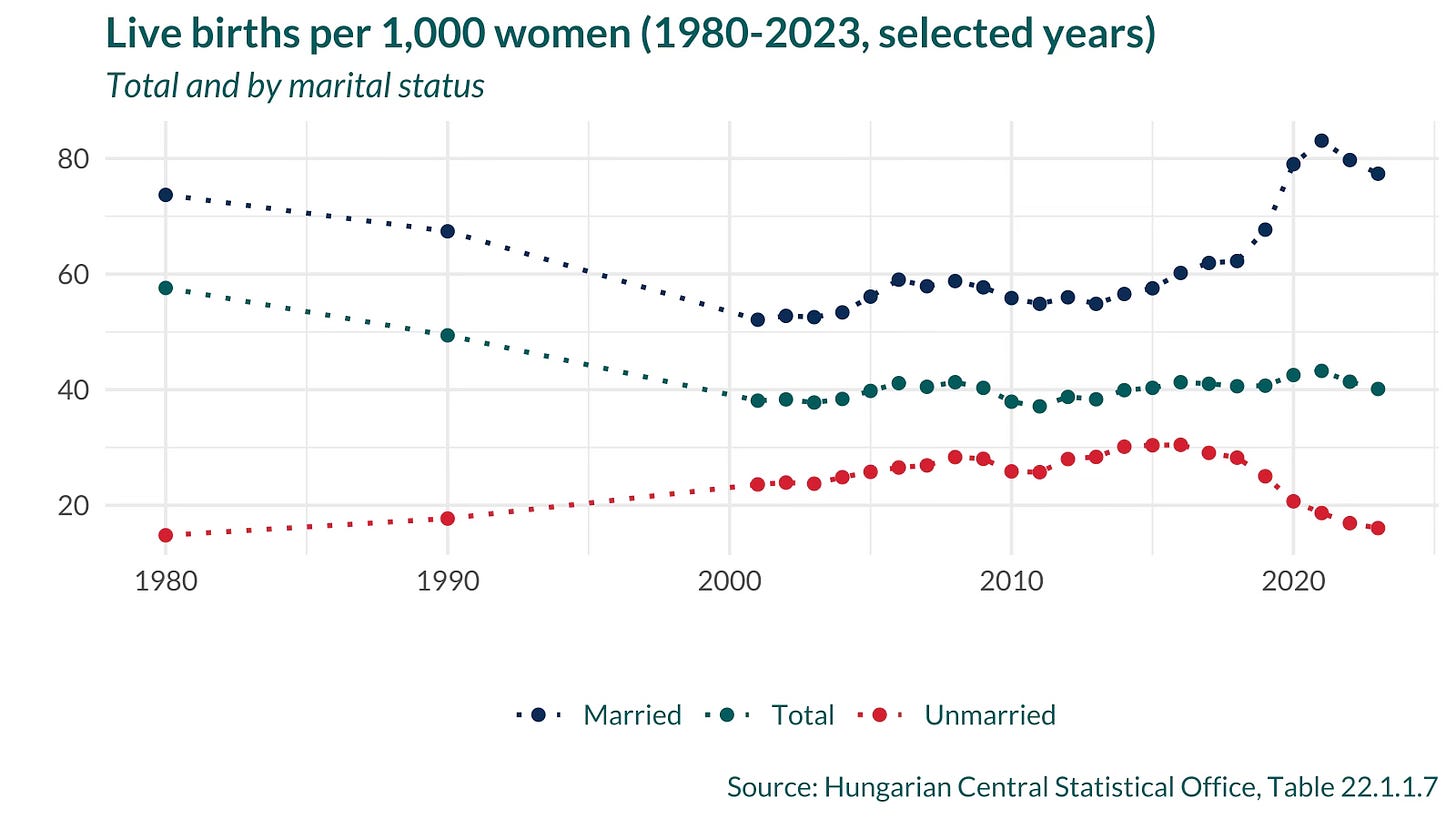

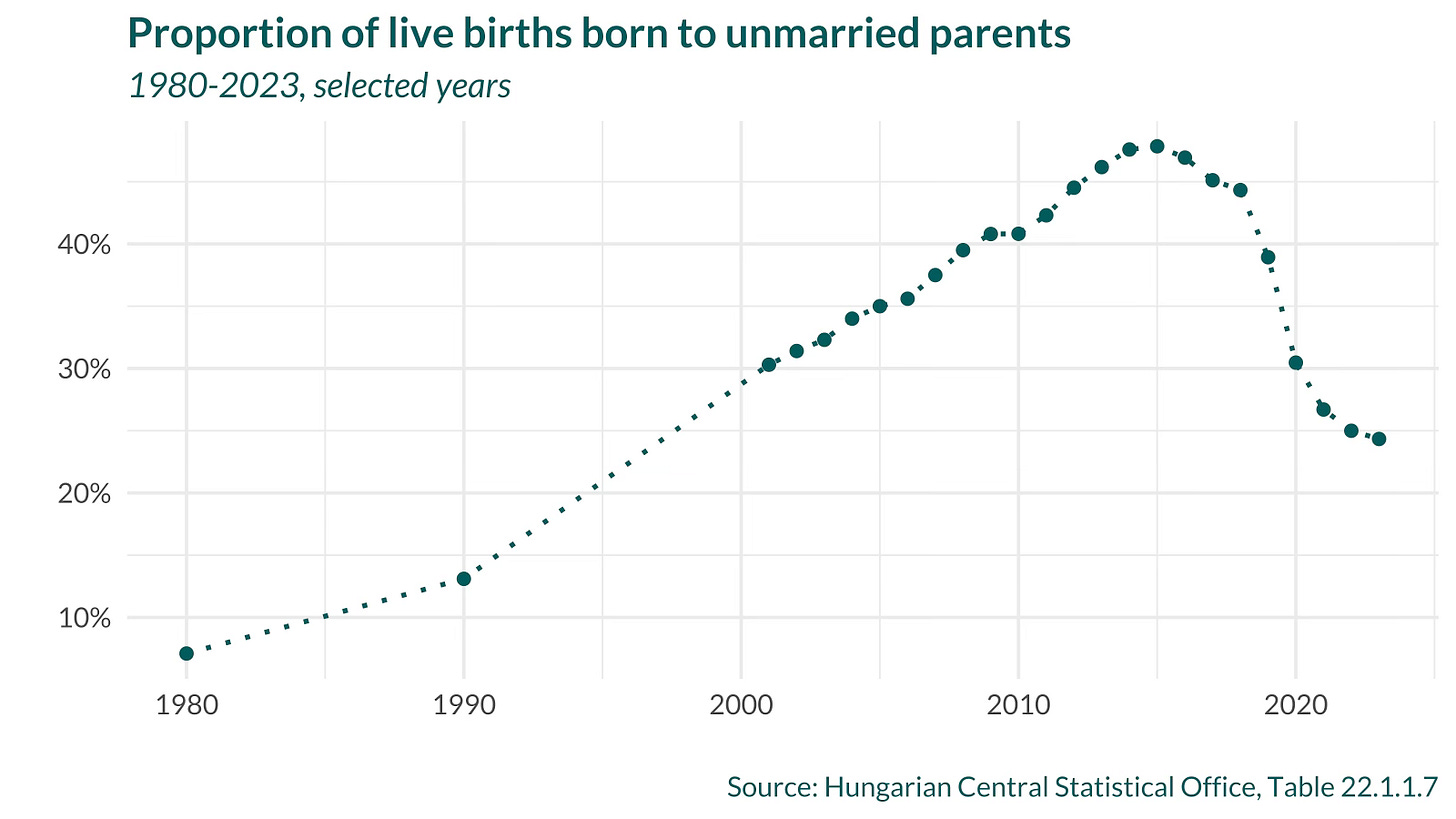

By far, the biggest impact Hungarian family policy has had is on marriage — tying benefits to marriage and placing a huge amount of cultural and political emphasis on marriage actually works! The hopeful sign for Hungary is that marital fertility surged during the rollout of Fidesz’ family suite of benefits, while non-marital fertility fell, such that the share of births outside of wedlock in Hungary today (24.3 percent) is lower than at any point during this century. If Hungary has succeeded in anything, it seems to be getting people who are planning to have children to get married — which is better for them, and better for their kids.

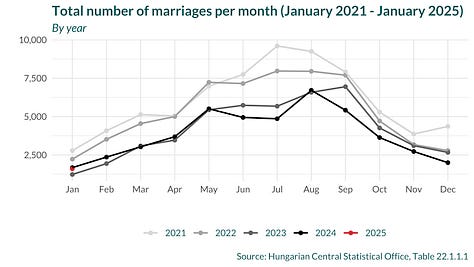

What’s unclear is whether it is leading more people to get married overall. The post-Covid surge in marriages has faded such that the number of marriages continues on its downward trend, and the average age at marriage continues to increase unabated. The average age at first marriage for Hungarian men is 33.5, for women 30.9; up from 30.4 and 27.9 just fifteen years ago. The surge in marriages for adults in their late 20s and early 30s that occurred around Covid seems to have faded.

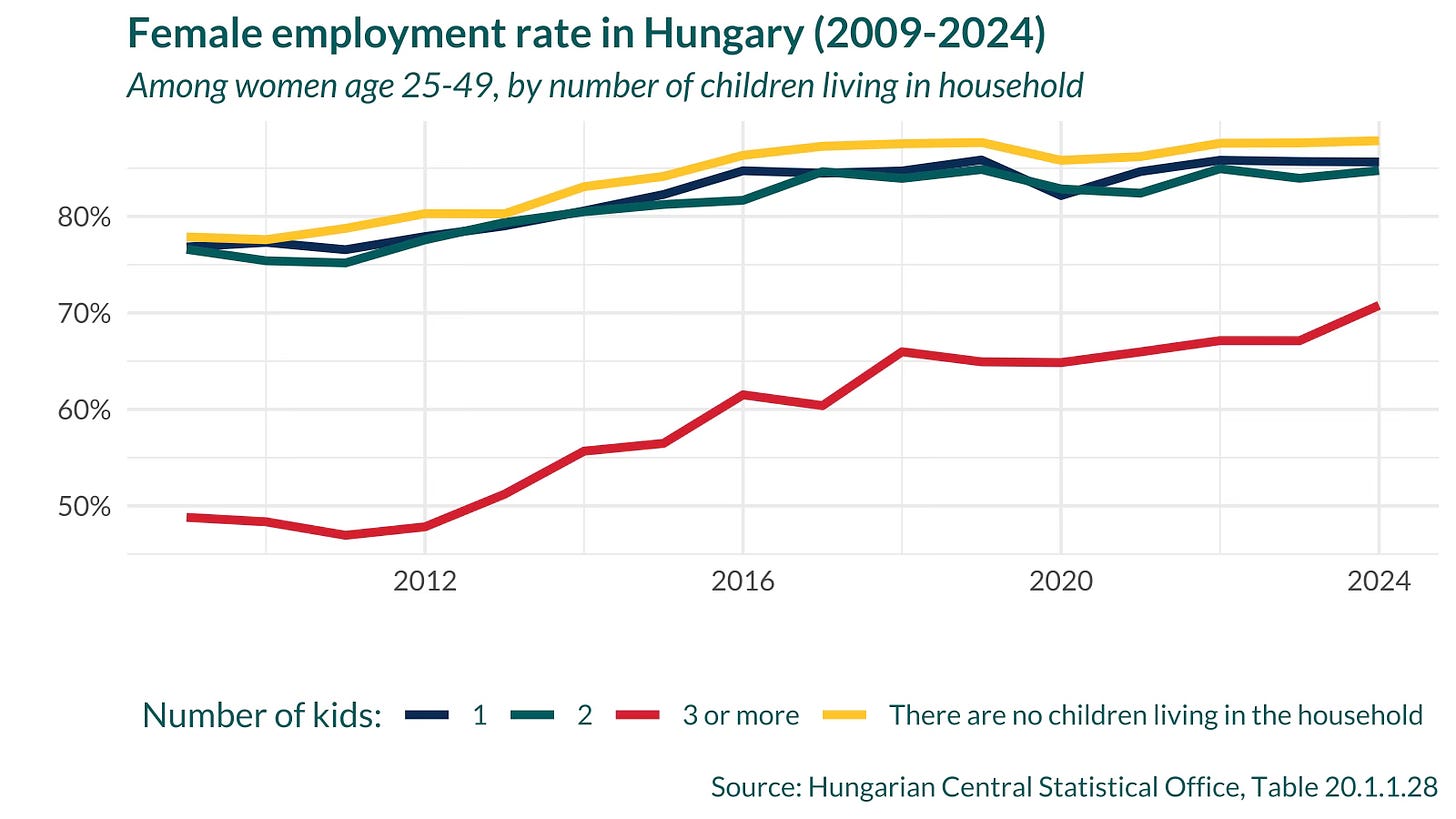

All this helps explain why Orbán’s latest move — while it is fairly billed as family-friendly — is more complicated than it seems. Hungary taxes income on an individual basis, rather than the U.S. system of married, filing jointly. This means that a woman who leaves the workforce upon having three or more kids (under the current tax system) does not actually receive much, if any, financial benefit until she goes back to work when the kids are grown. As estimated for The Federalist in 2018, the country’s initial approach left out nearly 90% of Hungarian women. Interestingly, the labor force participation rate among women with three or more children has been rising in recent years, though still (naturally) lags behind women with zero, one, or two kids.

The new policy will shift the threshold for no lifetime income tax down to two children, making it easier for women to hit the mark, but also increasing the returns to going back to work. The latest Hungarian family tax policy is essentially optimized to get women to have two kids and then get back to work as soon as possible; undoubtedly good for the labor force participation rates, but far from the pro-natalist utopia of large families some of its more vocal cheerleaders seem to envision.

Hungary has always been of most interest, to me, as a countercultural example of what a nation-state that wants to buck the homogenizing trend of globalization can do. The biggest lesson for U.S. audiences is that economic incentives can matter on the margin — a robustly pro-marriage focus on safety net policies can, at the very least, pull forward some marriages and reverse the increase in babies born out of wedlock. Highly salient benefits tied to marriage and family sign can arrest — though not reverse — demographic decline. The United States doesn’t, and shouldn’t, make a carbon-copy of Hungarian tax and transfer policies to bolster family formation domestically. But the experiment is worth keeping an eye on, and learning from.

Back in the U.S.A.

Meanwhile, the Centers for Disease Control released its final report on births for 2023. Here’s the most important takeaway:

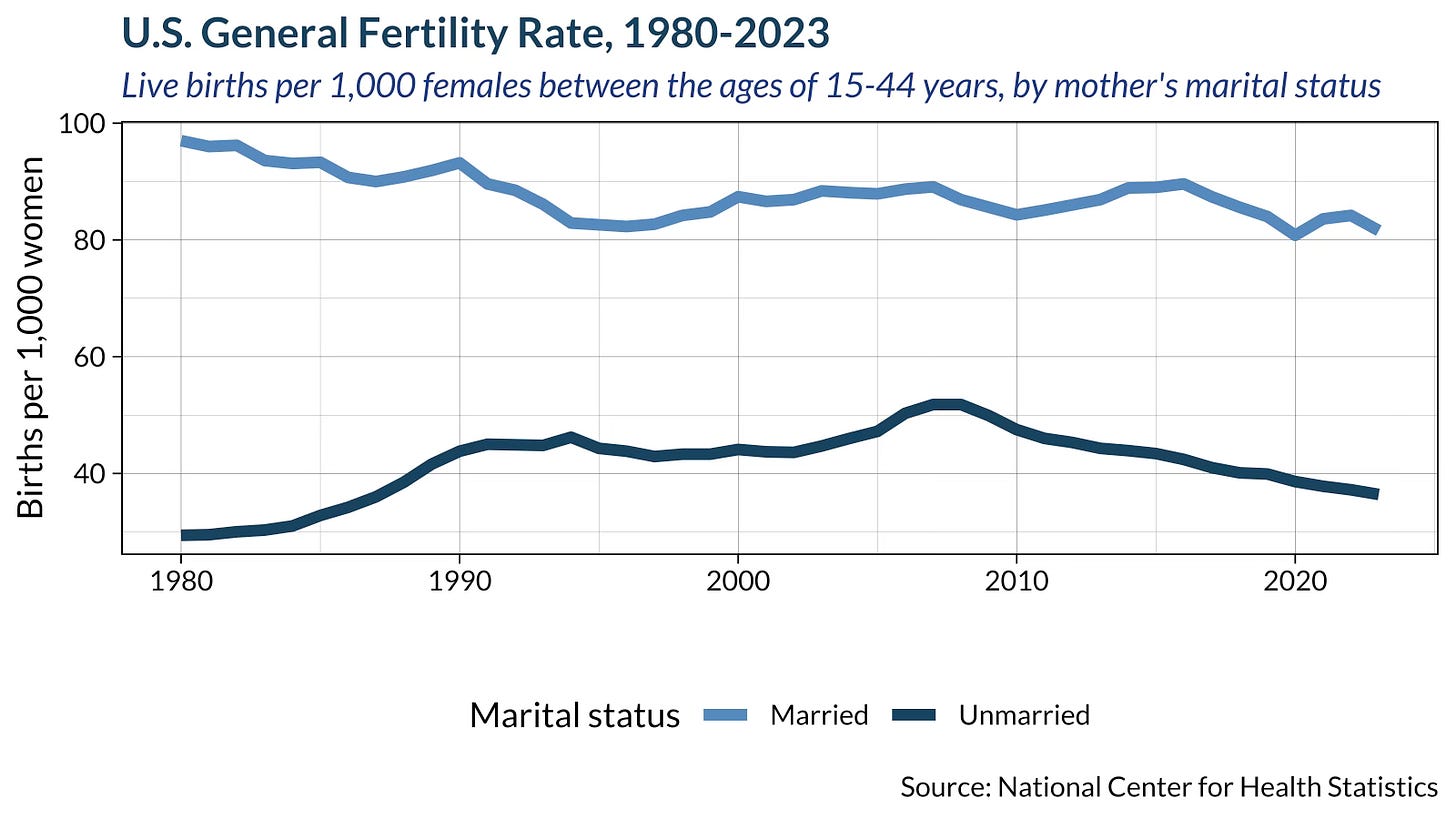

The birth rate to unmarried women has now fallen to 36.4 babies per 1,000 unmarried women in their childbearing years, 30 percent below its all-time high in 2008. Married fertility fell as well, by 3 percent, to 81.6 per 1,000 married women age 15-44.

Overall, the U.S. had fewer total babies in 2023 (3,596,017) than it did in 1979, a time at which the U.S. population was one-third smaller than it is now.

The states with the biggest decrease in fertility rates (5 percent or more): California, Delaware, Maine, Maryland, Nevada, Rhode Island, and Vermont.

It’s Me, Hi

I spoke to Our Sunday Visitor’s Kimberly Heatherington about the movement among states to create their own child tax credits:

“Seeing states like Indiana, which has extremely robust legal protections for the unborn, contemplate creating a state-level newborn child credit is a genuinely hopeful sign that more states will support parents in this important way.”

I was extremely happy to sign a letter, spearheaded by Americans United for Life, encouraging Congress to include pro-family, pro-life priorities in their upcoming negotiations. Our asks: Expand the Child Tax Credit, extend paid family leave, support pregnancy resource centers, and provide immediate support to new parents

Parting Shots

Caitlin Flanagan thoughtfully explores what a world of personalized AI content could mean for men: “When straight men don’t need women for sex, a question starts to form: What do they need them for?” (The Atlantic)

Kudos to the Palmetto Family Council, which has taken a strong stand against bills that would allow casinos and sports betting into the state - “We must not allow South Carolina to become a gambling mecca.” (FitsNews)

Rep. Kat Cammack (R-Fla.) and a host of cosponsors introduced a bill to strengthen state maternal mortality review committees and share best practices to improve maternal health

Minnesota state Rep. Jess Hanson has introduced a proposal to increase the state's Child Tax Credit by an additional $400 in the first year of a child's life

Sen. Katie Britt (R-Alabama) is pushing Republicans to include her bipartisan child care legislation, which would increase the CDCTC and make it fully refundable, in the upcoming reconciliation negotiations (Semafor)

In Ohio, Republican lawmakers have rejected Gov. Mike DeWine proposal to introduce a state child tax credit which would have been paid for by an increase in taxes on cigarettes (Ohio Capital Journal)

Them Before Us’ Patience Sunne has a quick, clear explanation of why “Right to IVF” bills are not the harmless nod to political reality too many red state legislators seem to think they are (Washington Stand)

Emily Tate Sullivan reports that some school districts, such as in Oklahoma City and Tuscon, are converting public schools that are shuttering due to lack of enrollment into child care facilities (EdSurge)

Comments and criticism both welcome, albeit not quite equally; send me a postcard, drop me a line, and then sign up for more content and analysis from EPPC scholars.

Increased male earnings increases fertility, but increased female earnings does not (aside from assortive mating).

There are only so many hours in a day, and if your raising four kids it’s going to be really hard to work (and daycare cost paid by you or the government are going to drain all your income).

Of course you could outsource earnings to a husband and focus on spending time with the kids you made, but without married filing jointly you get no tax benefit.

Hungary has a former communist attitude that the state should subsidize working women but not SAHM. As a result they are plowing money into something that is unlikely to work that well.